The landscape of mergers and acquisitions (M&A) is shifting, with many deals being pushed into 2024, setting the stage for what we anticipate will be a red-hot market in the coming year. Similarly, the IPO market has been sluggish, making it challenging for firms to exit their investments and venture into new deal activity.

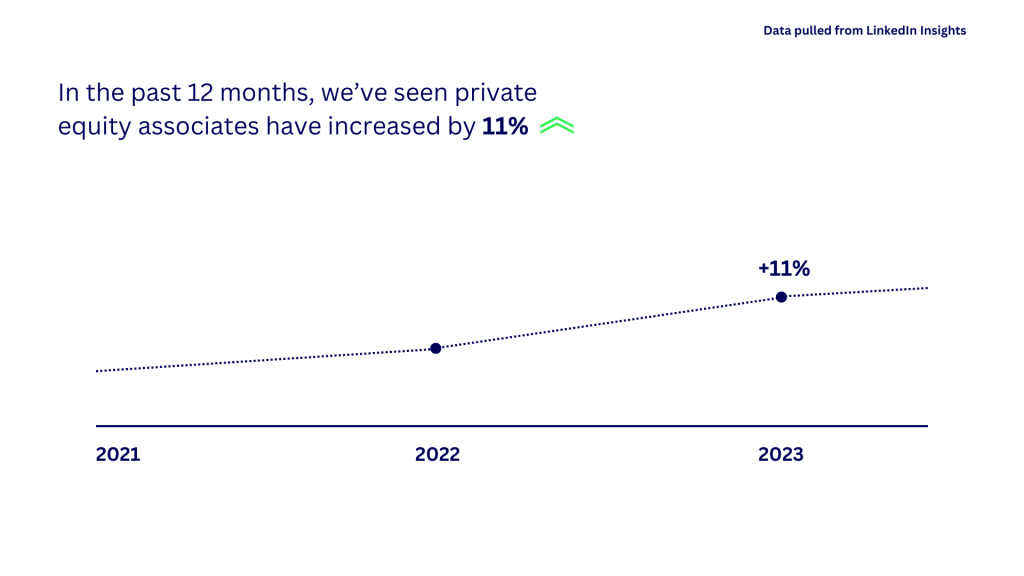

Despite these challenges, our performance this year has been robust, marked by high billings, even in a down market, and significant growth as we expanded our private equity team to ten members.

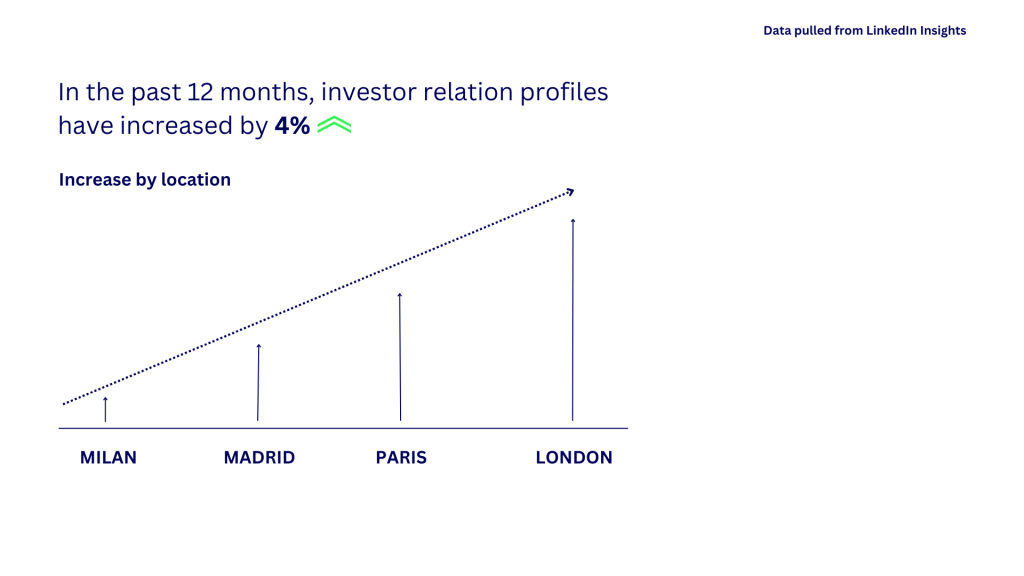

Notably, investor relations positions are rapidly gaining traction in our business, with experienced fundraisers now in higher demand than ever.